New Frontier Data explores the potential implications of changes to the EU’s Novel Foods legislation.

In July 2020, news broke that the European Commission was suspending applications for CBD to be included in its Novel Foods catalogue, stating that CBD and other extracts from hemp flowers would be better regulated as narcotics under the United Nations (UN) Single Convention on Narcotics of 1961. While it is a preliminary conclusion, the potential ramifications have sent shockwaves through the nascent European CBD market.

The ruling, if upheld, would not only make it impossible for Europe’s CBD market to exist in its current form, but would also limit cannabinoid research and innovation throughout the continent. Permitting synthetic cannabinoids while prohibiting plant-derived extracts would essentially quash any hopes for a legal, regulated hemp-based CBD industry.

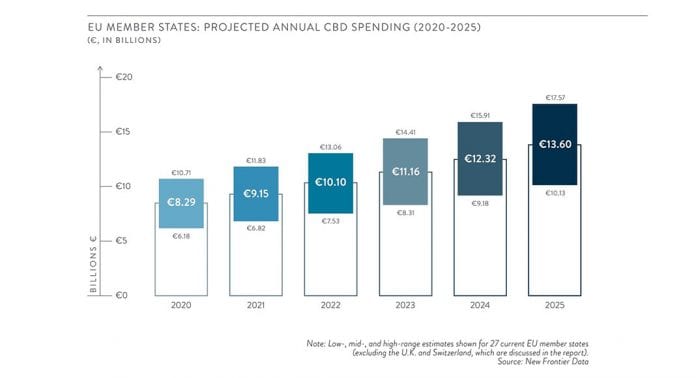

In its recent EU CBD Consumer Report Vol. III: Market Size and Demand, New Frontier Data noted that although the CBD market in the EU experienced strong initial growth over the past few years, it remains immature compared to the US market. Annual spending on CBD in the EU is expected to total an estimated €8.3bn (a mid-range estimate) for 2020, and is projected to grow at a compound annual growth rate (CAGR) of 10.4% to reach €13.6bn by 2025. Despite surging consumer demand and growing legal commercialisation globally, the Commission’s decision underscores the significant influence which the UN’s Single Convention continues to have regarding cannabis policy.

Novel Foods regulation and hemp

Last month, BusinessCann reported the Commission’s confirmation that it is still considering about half of the 50 applications it received before the freeze. The deciding factor appears to be how the CBD was extracted: those applications involving CBD extracted from fibres and seeds are being allowed to proceed, while CBD derived from flowering and fruiting tops of the hemp plant are being halted. While the Commission classified CBD as a Novel Food in January 2019, it now seems to have concluded that CBD extracted from one part of the plant is a food, while that extracted from another part is a narcotic.

That decision was immediately rejected by the European Industrial Hemp Association (EIHA), which criticised it as ‘against all reason, the latest scientific literature, and the EU green ambition’. During a recent segment of New Frontier Data’s Cannaweek podcast, Lorenza Romanese – Managing Director at the EIHA – concluded that if the preliminary conclusion becomes binding it would mean the end of the industrial European hemp sector.

New Frontier Data’s Chief Knowledge Officer John Kagia stressed the significant role played by industry stakeholders in ensuring that decisions are made in an informed way. He warned about the scale of impact which the ruling could warrant, considering where cannabis fits within our global society.

Towards an uncertain future

Brexit introduces additional uncertainty. The United Kingdom and Ireland together represent one of the largest regional markets for CBD in Europe, where consumers spend €1.7bn on CBD products annually. That market is projected to grow by over €1bn by 2025, to €2.8bn. While they have Novel Food regulations of their own, it is possible that the UK’s decoupling from the EU will usher in a brighter future for CBD producers. Like so much concerning the volatile regulatory space, the future is uncertain.

One likely scenario seen played out repeatedly is the development of a ‘grey’ market to meet the demand for products that consumers want or need without a legal framework. Earlier this year, the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA) released a special report confirming that illicit cannabis sales spiked as countries began initiating lockdown measures in response to COVID-19. If hemp-derived CBD products are classified as a narcotic, it is possible that some consumers will turn to the grey market to acquire CBD. That possibility comes with a range of negative externalities, including the risk of mislabelling, counterfeit goods, lower-quality products, and inclusion of harmful pesticides and toxins.

The future of Europe’s hemp industry appears to be hanging in the balance regarding how the decision is implemented. Will hemp-derived CBD be considered a Novel Food, or a narcotic? The verdict will prove to be a pivotal point which could have dire consequences for the European CBD market. We will continue to monitor the issue with keen interest.

New Frontier Data

+1 (0) 844 420 3882

sbentley@newfrontierdata.com

www.linkedin.com/company/new-frontier-financials

https://newfrontierdata.com/

This article is for issue 4 of Medical Cannabis Network. Click here to get your free subscription today.