Have you ever wondered about the applications and economics for industrial hemp? Here, Rob Kuvinka, manager of New Frontier Data, explores this further.

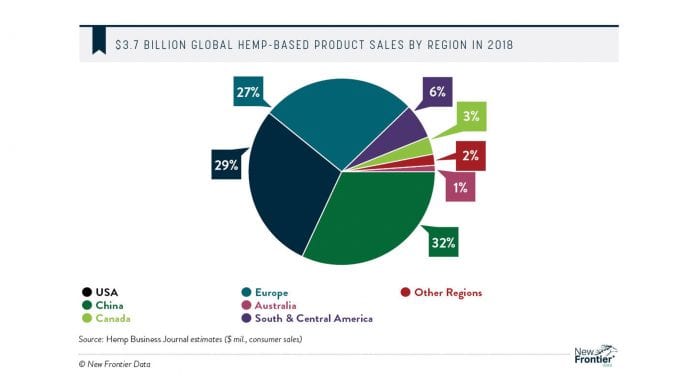

Used in Europe for more than 3,200 years, hemp today represents an annual market opportunity of $1 bn (~€692m) for the continent, and over $3.7 bn globally in 2018. Traditionally used for food and fibres, hemp is now used to make medicine – largely hemp-derived cannabidiol (CBD), industrial products, personal care products, and more. Understanding the opportunities for industrial hemp in Europe is critical as regulators and voters decide the plant’s future on the continent in coming years.

Let’s talk CBD

CBD is a non-psychotropic cannabinoid reported to have antiepileptic and anti-inflammatory properties. CBD represents one of the fastest-growing sectors of the global hemp industry, and projects to serve as a catalyst for the hemp industry’s expansion and maturation. In Europe, CBD sales are flourishing, particularly in the UK and Germany, with France and Italy among other countries presenting growing opportunities.

CBD products are manufactured in a wide range of product forms available from tobacco shops and vape stores, to traditional supplement stores like UK-based Holland and Barrett, and in convenience stores, supermarkets, and online retailers including Amazon. European-based manufacturers may focus more on retail presences, while foreign companies (like Australia-based Elixinol Global) are relying heavily on trading online.

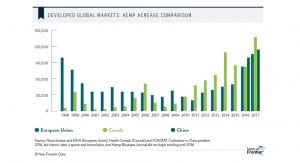

CBD is produced three different ways – pharmaceutically or derived from either hemp or marijuana. All three production technologies are expected to contribute, roughly equally, to future CBD sales. CBD is a particularly important growth sector for European producers, as the region is one of only three worldwide to have developed mature hemp production (Canada and China being the others).

First-mover advantages may allow European producers to capitalise on growing global demand for CBD. Growth in CBD will be largely driven by the United States, where CBD sales are expected to grow at a 36% CAGR until 2022. By then, pharmaceutical, marijuana, and hemp-based CBD will each represent roughly equal portions of sales (around 33% apiece), compared today to 51% hemp-based CBD and 49% marijuana-based CBD (the first pharmaceutical product, Epidiolex, was approved a year ago). Pharmaceutical CBD products in Europe have a head start, being available longer than any elsewhere in the world.

Nevertheless, there are some major threats facing CBD in Europe. First and foremost, in January 2019, the European Food Safety Authority (EFSA) changed its guidance on cannabinoids, stating that “products containing cannabinoids are considered novel foods as a history of consumption has not been demonstrated.” This caused CBD (a cannabinoid) to go from being permitted in food in European states (if the THC content was below 0.2%) to becoming a fully unauthorised novel food, potentially putting the CBD market on hold for several years as health and safety trials are conducted.

However, a recent application to the EFSA filed by Czech producer Cannabis Pharma may allow food containing under 130 milligrams of CBD to be allowed.

The industry awaits the outcome of the application, with a pending decision expected anytime, and wider significance in the offing for CBD food products. Country-by-country regulations also hamper uniformity about which parts of the hemp plant may be used. In Germany and Romania flowers and leaves can be harvested, but in France and the Netherlands only fibers and seeds can be used. In some countries, extracts are illegal whether from hemp or marijuana, but in others they are allowed so long as THC levels remain below

the standard.

The many faces of hemp

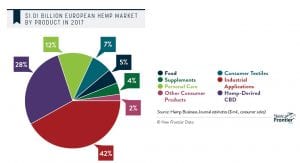

While CBD garners much of the media attention, the largest market for hemp in Europe is, and will continue to be, in other sectors. New Frontier Data has identified seven primary product sectors for hemp – food, supplements, personal care, consumer textiles, industrial applications, and hemp-derived CBD. Fig. 2 lists the most common products for each sector.

Fig. 3 shows that Europe has developed both a strong processing infrastructure and a finished goods industry based on using hemp fibers in industrial applications. It is the largest current market segment for hemp in the region, at 42%. Furthermore, New Frontier Data predicts that sales of hemp-based industrial products will post the strongest growth of any hemp sector over the next five to 10 years.

Paper and pulp (for cigarettes and specialty paper applications), along with biocomposites (used in the automotive industry, and for insulation materials), are the most established uses in Europe for the fibers from hemp plants. Hemp shives, a byproduct of the fiber-extraction process, also have long-established European commercial uses, primarily as animal bedding, but also increasingly for use in the construction industry, especially for insulation.

Other top market segments for hemp include food (cold cereals, hemp milk, hemp seeds, and meat alternatives including hemp burgers), non-CBD supplements (with protein supplements being the top products), and personal-care products (e.g., shampoo, lotions, soap, deodorants).

European hemp production

Today, Europe is estimated to produce close to 1/4 of the world’s hemp crop. While the continent had been the historical global leader in hemp production until about 2010, it has recently been surpassed by Canada, with China has quickly catching up (see Fig. 4). France alone accounted for 40% of the European acreage, with at least 20 other countries contributing to the European Union’s total.

Europe will continue ramping up hemp production in the coming years, growing from $1 bn in 2018, to $1.51 bn in 2020. New Frontier Data anticipates that such growth will come in the face of major headwinds, as passage of the 2018 Farm Bill in the United States is allowing hemp to be produced in the world’s largest economy for the first time since World War II. Such heightened supply will limit potential exports for European producers, though European countries with established hemp industries are nevertheless positioned to grow domestically throughout the EU, and into international markets.

New Frontier Data

+1 (0) 844 420 D8TA (3882)

info@newfrontierdata.com

Please note, this article will appear in issue 10 of Health Europa Quarterly, which is available to read now.

How does ICC fit in this growing European market?