Europe’s hemp-derived CBD market is currently the second-largest CBD market after the U.S. – but what do you know about customer behaviour and consumption?

Despite the growth in interest and accessibility, there remain significant gaps in understanding consumer perception, use, and attitudes about CBD. New Frontier Data recently released the findings from their expansive European survey that examined the rates of awareness and use of CBD among consumers in 17 countries across the European Union (EU). Here, Molly McCann, Senior Manager, Industry Analytics and Josh Adams, Industry Analyst of New Frontier Data give us an insight into the latest report regarding Europe’s burgeoning CBD market.

Did you know that New Frontier Data are partners with us? Learn more about New Frontier and their mission to elevate discussion around the legal cannabis industry.

The CBD market

Our newest report, The EU CBD Consumer Report: 2020 Segmentation & Archetypes, continues New Frontier Data’s in-depth consumer research on CBD in the EU. This report highlights CBD purchase and use patterns across a range of consumer segments to provide a granular understanding of the current European CBD consumer. Additionally, New Frontier Data has identified a spectrum of CBD archetypes, including both current CBD consumers and nonconsumers, that define groups based upon their distinct patterns of behaviour and consumption.

Through the identification and analysis of these consumer archetypes, New Frontier Data can provide a more informed understanding of who purchases and consumes CBD products, how and why they consume those products, as well as those consumers who have yet to purchase or consume CBD.

Did you know that our partners New Frontier Data have the mission of collating and analysing data regarding the ever changing cannabis industry? Read more in their eBook and learn all about their trusted cannabis industry research.

Consumer archetypes

Based upon our analysis of rich survey data from the EU and US, New Frontier Data has identified five overarching archetypes of CBD consumers. These consumer archetypes are the Exuberant & Intense, Integrative & Consistent, Skeptical & Limited, Receptive & Reserved, and Ambivalent & Experimental. These archetypes are defined by their attitudes, beliefs, and interactions with CBD. In descending order of consumption frequency, they are:

The Exuberant & Intense are the smallest group of consumers (11%), and the most extreme. They are voracious consumers of CBD products, using CBD the most frequently of any archetype in the widest variety product forms and broadly expressing interest in trying new products. They are the highest spenders among CBD consumers, and have overwhelmingly positive feelings about CBD. Exuberant & Intense consumers are also the most recent adopters as more than a third (35%) reported that they first consumed CBD less than a month earlier, so their aggressive consumption practices might be indicative of an initiation stage. Over time, it is likely that their use will stabilise as it is more carefully calibrated to reflect specific applications and target outcomes.

The Integrative & Consistent—the largest group of consumers (29%) sit comfortably in second place after the Exuberant & Intense consumers. They are the second-most frequent consumers (most use it at least once a week), and the second-highest spenders on CBD. The Integrative & Consistent likely represent the most stable archetype among consumers, as they consume CBD for a wide variety of reasons and have deeply integrated CBD into their lives and understandings of their own health and wellness. They have an exclusively positive impression of CBD, and are staunch believers in its medical efficacy.

The Skeptical & Limited, who account for 20% of consumers, are moderate-frequency users that are broadly uninterested in trying new forms or products, and do not seem to have actively incorporated CBD into an overall lifestyle practice. Their impression of CBD is still mostly positive, but they are generally wary of health claims and purported benefits, and least likely to support CBD’s being freely available to the general public. Over time, it is possible that some Skeptical & Limited consumers may eventually feel that their concerns have been adequately addressed, at which point they may transition to joining the Integrative & Consistents, or more likely, Receptive & Reserveds.

The Receptive & Reserved are also moderately frequent consumers who make up nearly a quarter (23%) of European CBD consumers. They are the least likely group to have other CBD consumers in their social circles, but they have very positive feelings about CBD, believe strongly in its medical efficacy, and support its broad availability. Without recommendations coming from family and friends, they have not incorporated CBD thoroughly into their lifestyle; they engage with a relatively narrow range of CBD forms but show an interest in trying new forms and learning more about CBD. Many Receptive & Reserved consumers are likely to remain moderate and relatively isolated CBD consumers. However, as the CBD markets they live in mature, some will have access to a wider variety of products, potentially satisfying their interest in trying new product forms and drawing them into more regular use.

The Ambivalent & Experimental (17% of consumers) are the only consumer archetype that have consumed but not purchased CBD, instead sourcing it informally, typically from friends and family. They are also the least frequent consumers (many have tried CBD only once or twice), have the fewest defined reasons for using CBD, and tend to have relatively conservative beliefs about CBD overall. Ambivalent & Experimental consumers are among the least likely to convert into routine CBD consumers. However, there is a subgroup within this archetype that might be brought back into the fold: About a third (35%) of this archetype first consumed CBD more than a year before completing the survey, and in the interim CBD product offerings have diversified significantly. There could be some who (though unsatisfied with their experimentation with CBD in the very early days of the market) may be sufficiently compelled by new product forms or other recent developments to give CBD another try.

Nonconsumer archetypes

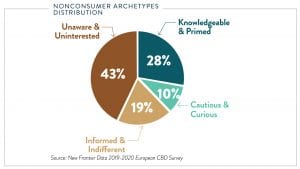

We also identify four overarching archetypes of CBD nonconsumers: each the Unaware & Uninterested, Knowledgeable & Primed, Cautious & Curious, and the Informed & Indifferent. Each archetype represents a segment of nonconsumers who have yet to purchase or try CBD products and have broadly differing levels of awareness and openness to CBD.

The Unaware & Uninterested are the largest segment of CBD nonconsumers. These nonconsumers are broadly uninterested in CBD, have not seen any CBD products available in stores or online, and are uninterested in learning about it. They are not curious about trying CBD and have no plans on purchasing CBD in the future. The Unaware & Uninterested are, broadly speaking, unlikely to try CBD products in the current market. However, as the accessibility of these products increases and information about CBD is more widely disseminated, these nonconsumers might be open to experimenting with CBD.

The Knowledgeable & Primed comprise just over a quarter (28%) of CBD nonconsumers. These individuals are the most curious about trying CBD and have a broad awareness about CBD products. They have a positive impression of CBD and express a strong belief in the benefits and efficacy of CBD. The Knowledgeable & Primed also support broad access to CBD products for consumers. Additionally, these nonconsumers are the most likely to say they will purchase a CBD product in the next 6 months. As such, the Knowledgeable & Primed are the mostly likely of all nonconsumer archetypes to become CBD consumers.

The Cautious & Curious nonconsumers are moderately curious about trying CBD but have not because they feel they do not know enough about it. This archetype expresses a general apprehension about the safety, efficacy, and legality of CBD. However, these nonconsumers also want to learn more about CBD and, based upon their general openness, some of these individuals may become comfortable enough to try it.

The Informed & Indifferent represent a segment of nonconsumers that are most likely to have seen CBD in stores, to have had conversations about CBD, and are generally informed about CBD’s properties. However, they express little curiosity about trying CBD and have no plans to purchase CBD products. Based upon their foundation of awareness about CBD combined with their continued abstention from using CBD products, this archetype is among the least likely to be converted from a nonconsumer to a consumer.

The European CBD survey is part of New Frontier Data’s ongoing series of CBD-focussed research projects examining the marketplace in the United States and globally to provide in-depth insights on the growing CBD industry. To learn more about CBD consumer archetypes, download our newest report The EU CBD Consumer Report: 2020 Segmentation & Archetypes.

Molly McCann

Senior Manager

Industry Analytics

Josh Adams, Industry Analyst

New Frontier Data

Please note, this article will also appear in the second edition of our quarterly publication, Medical Cannabis Network Quarterly. Subscribe here for all the exciting news updates.